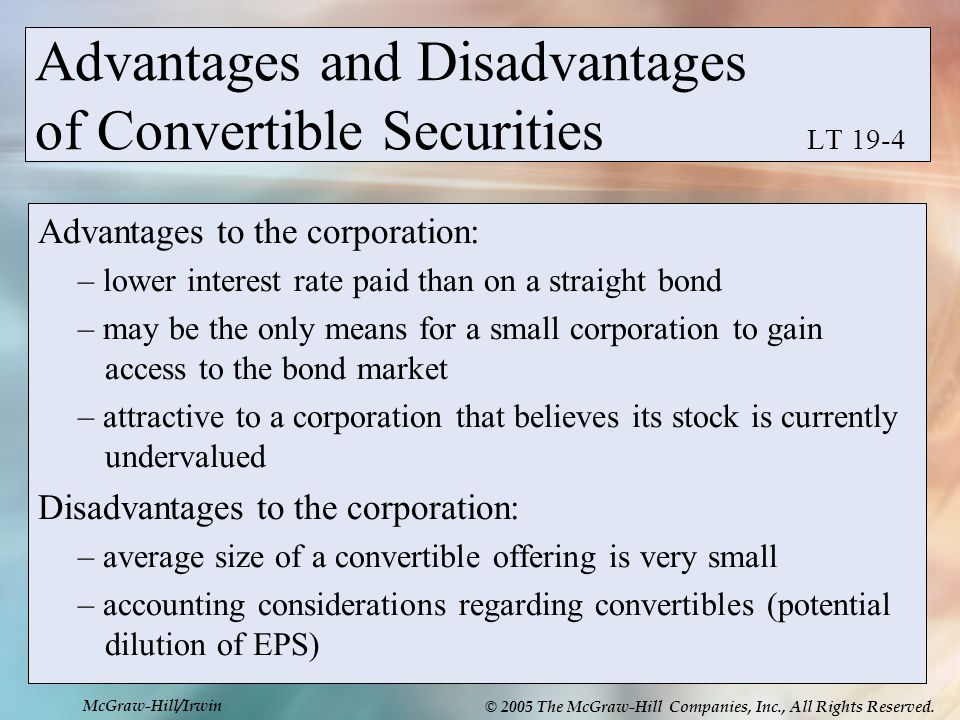

Convertible Bonds Advantages and Disadvantages

ABC Co has issued 100000 units of convertible bonds with a nominal value of US100 each. A zero-coupon bond is a type of bond with no coupon.

Convertibles Warrants And Derivatives Ppt Video Online Download

The advantages and disadvantages of preferred stock have changed little over the years.

. Different Types of Bonds Plain Vanilla Bonds. Key Takeaways While less exciting perhaps than stocks bonds are an. An investor is entitled to receive a dividend from the company.

Here well explain some of the advantages of bonds and offer some reasons you may want to include them in your portfolio. The other source of return on investment apart from dividends is capital gains. It is one of the two primary sources of return on his investment.

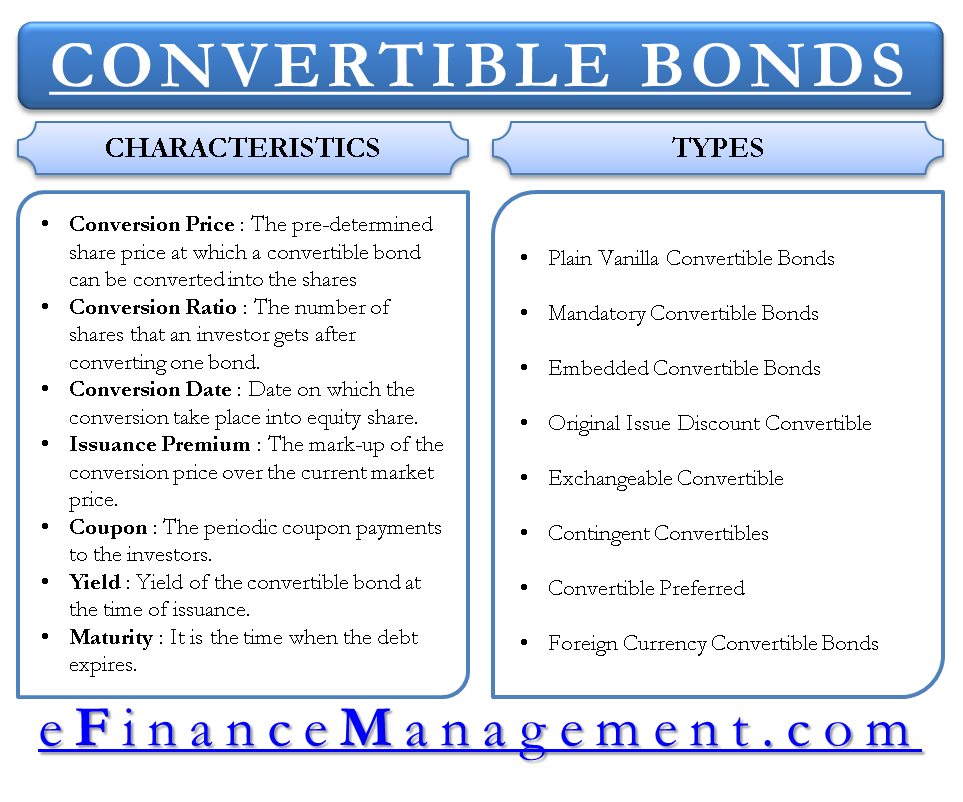

Some corporate bonds are structured to be convertible which means they can be exchanged for shares at some point in the future. It is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. If any bonds are not converted such bonds would be redeemed at US110.

May invest up to 10 of its assets in companies domiciled outside the United States. Advantages of issuing corporate bonds. A plain vanilla bond is a bond without unusual features.

Bank accounts and marketable securities like debt securities where the maturity date is less than 90 days treasury. Most of them get issued by entrepreneurial startups today following in the footsteps of the railroad and canal companies in the past. They can be secured or unsecured and.

In either case dividends are only paid if the company turns a. Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. Cash and cash equivalents are those items which are recorded in the balance sheet of the company and refers to the value of the assets of the company which are held in cash or can be easily convertible to cash ie.

Types of Financial Instruments. It carries financial value and represents a binding agreement between two or more parties. These shares are an option that has fallen out of favor in some circles but it deserves a second look.

Primarily invests in common stocks and securities convertible into common stocks. It is also known as a straight bond or a bullet bond. During the 1960s the United States was caught up in a conglomerate fad which turned out to be a form of speculative mania.

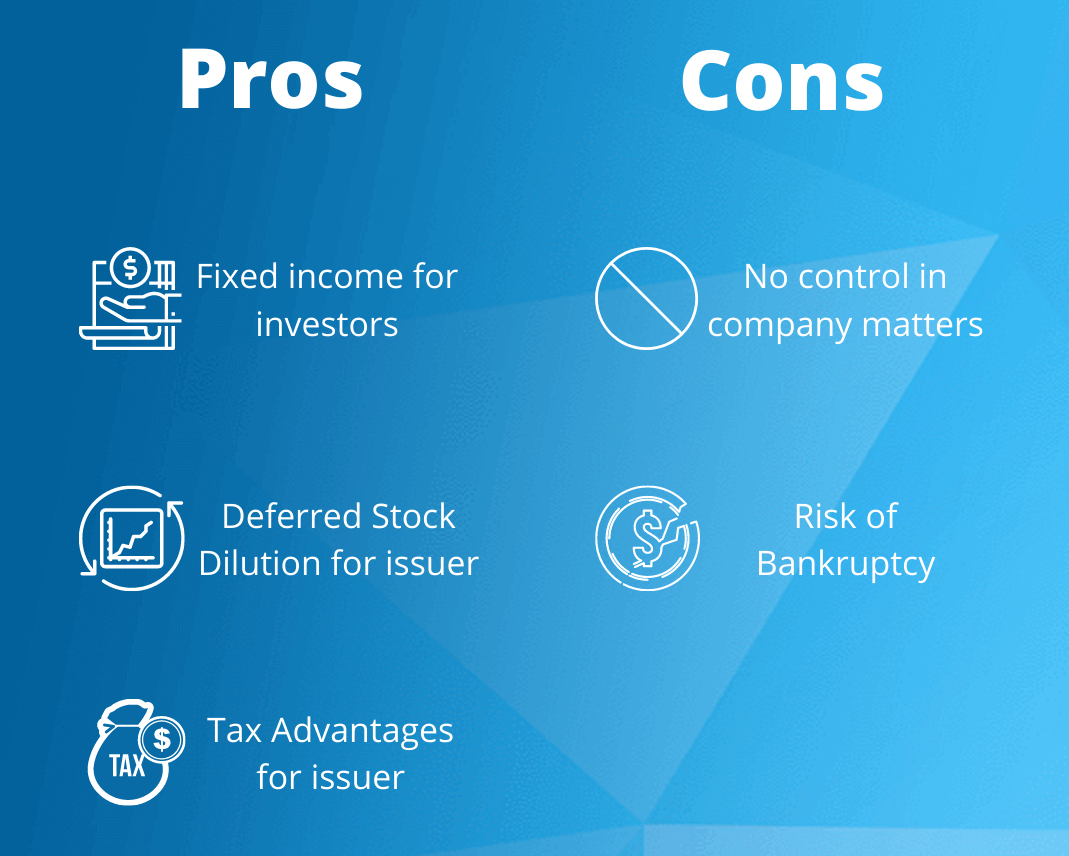

CompaniesIssuers Holdings are as of. Advantages of Preference Shares Owners of preference shares receive fixed dividends well before common shareholders see any money. If bonds are sold on the public market they can be traded - similar to shares.

Bonds can be a very flexible way of raising debt capital. A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of goldThe gold standard was the basis for the international monetary system from the 1870s to the early 1920s and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold. Gains arise due to a rise in the.

United States The conglomerate fad of the 1960s. Due to a combination of low interest rates and a repeating bear-bull market conglomerates were able to buy smaller companies in leveraged buyouts sometimes at temporarily deflated values. Each of the US100 convertible bonds can be converted into 50 ordinary shares in three years time.

Advantages and Disadvantages of Investment in Equity Share Capital Advantages Dividend. As of 8312022. Fund Inception 7311952 Fund Assets millions As of 8312022.

Examples of financial instruments are bills of. Holdings Outside the US. It is used by investors to predict future value.

The coupon rate of the bonds is 10 payable annually. It is a document that represents an asset to one party and liability to another. A financial instrument is a financial contract between two parties.

Definition of Cash and Cash Equivalents. Cash Equivalents.

Convertible Bonds Primer Debt Conversion Features

Convertible Securities Ppt Video Online Download

0 Response to "Convertible Bonds Advantages and Disadvantages"

Post a Comment